Audio Series platform Pocket FM today unveils the findings of the second leg of its entertainment consumption survey ‘Digital Entertainment Insights: Audio Takes The Centrestage’. The survey, conducted every quarter across India, aims to understand the digital pulse of the nation and delves into the preferences, behaviours, and attitudes of internet users towards various forms of digital entertainment.

Audio Takes The Centrestage: Key Metrics

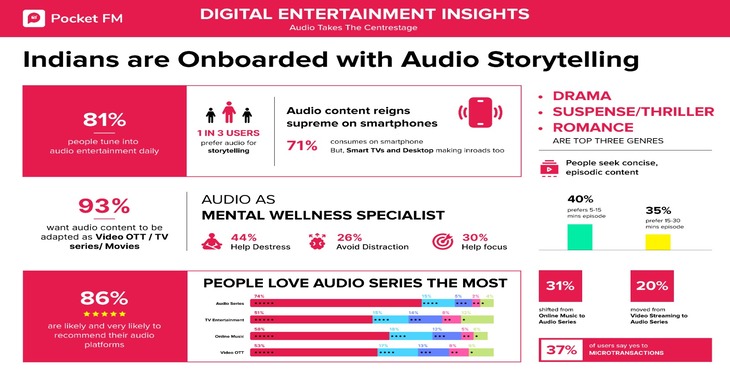

The findings suggest a resounding shift towards audio formats, with 81% of people engaging with audio entertainment daily. Storytelling emerged as the primary catalyst for its irresistible pull, with one in three users expressing a distinct preference for this engaging and immersive format. The other triggers are convenience, influencing every 4th user, and content diversity, affecting every 6th user to adopt audio as a preferred content medium.

Regarding devices, 71% of users consume audio content on their smartphones, highlighting the convenience and accessibility that mobile devices provide. However, 29% of users prefer to consume audio through tablets, smart TVs, desktops, and other devices, showcasing the rise of audio consumption at the workplace and home.

Genre-wise, drama emerged as the leading genre, capturing the attention of 22% of users, closely followed by suspense and thriller at 21%, romance at 17%, sci-fi at 12%, and comedy at 11%.

Users seek concise, episodic content— want audio storytelling to be evolved into video

Approximately 40% of users lean towards shorter episodes lasting between 5-15 minutes, while 35% prefer slightly longer episodes in the 15-30 minutes range. Only about 25% of users prefer longer content, opting for episodes spanning approximately 45-60 minutes.

The rising popularity of audio entertainment is evident, with a notable shift in how people envision audio content. A staggering 93% desire to adapt audio content into visual formats such as video OTT, TV series, and movies. As audiences seek multi-sensory engagement, the call for transforming audio storytelling into visual mediums underscores the evolving nature of content consumption in today’s digital age.

Audio Emerges as Mental Wellness Specialist

Audio extends beyond entertainment, proving itself as a valuable productivity tool. 44% of users find audio for stress relief and believe it to be a soothing escape amidst daily pressures. Moreover, 30% leverage audio to enhance focus, creating an immersive environment for improved concentration during work or other cognitive activities.

About 26% look at audio as a means to avoid distractions. This multi-role of audio highlights its versatility, serving as a source of entertainment and a crucial element for effective and mindful living.

Trust is key; Audio is winning it.

When it comes to content selection, trust plays a deterrent role. 42% of users rely on content recommendations from the platform itself, while recommendations from friends and family (17%) and social media (21%) also wield significant influence. Surprisingly, only 6% of users are swayed by influencers, indicating a higher level of disconnect with their recommendations among the audience.

58% of users are highly likely, and 28% are likely to recommend their favourite audio platforms, showcasing a strong belief in the quality of auditory content. When it comes to spreading the word, good old-fashioned word of mouth leads the pack, with 42% of users relying on recommendations from friends. Social media is just a little behind, influencing 36% of users.

Zooming into specific audio content, audio series steal the spotlight, with 74% giving 5-star recommendations. In comparison, 51% give 5-star ratings to TV entertainment but get a rating of 3 or below from 33% of users. Online music and video OTT also fare well, with 58% and 53% of users giving 5-star ratings, respectively, but rated 3 or below by 23% and 31% of users, highlighting a shift in the audience’s digital entertainment preferences.

Audio Series is the winner but at the cost of …

The survey unveils the increasing popularity of audio entertainment, prompting a seismic shift in user preferences. 31% of users transitioned from online music to audio series, indicating a dynamic redefinition of audio entertainment consumption patterns. Similarly, 16% felt that their entertainment consumption shifted from social media and short video consumption, while 20% believed that audio series had replaced their video streaming habits. Even audio series have influenced other spoken-word content formats, such as audiobooks and podcasts, with approximately 17% of users experiencing a shift from these formats.

Only 16% feel their entertainment time spent increased with audio series.

Pay for Play – The time has come for Audio!

As the landscape evolves, so do monetisation trends. While 23% prefer subscription-based models, the survey indicates a growing appetite for flexible pricing, with 37% of users open to paying for individual episodes. Only 40% of users still favour ad-supported and promotional models to drive consumption on audio platforms.

Speaking on the findings of its second edition of Digital Entertainment Insights, Rohan Nayak, CEO and co-founder, Pocket FM, said,” The outcome of the survey reflects a remarkable shift in consumer content consumption preferences, signalling the rise of audio as a dominant force in the entertainment landscape. Audio is not merely a trend, but it has become a lifestyle, driving engagement that exceeds any other entertainment medium. The findings strongly suggest that audio series is set to dominate audio entertainment, and we believe, it will emerge among the top 3 entertainment formats in the next couple of years.”

“As we welcome this audio revolution as an opportunity, we are committed to leading the way into a future where audio takes centre stage in the hearts and minds of millions of audiences across the world,” added Nayak.

Methodology

The survey encompassed a diverse cross-section of the Indian population, with a total sample size of 22,442 internet users, conducted between 28th October 2023 and November 15, 2023. Regarding gender distribution, the respondents comprised 69% males and 30% females. Delving deeper into age demographics, 58% of the sample are Millenials, 35% represented GenZ and 7% belong to GenX. Geographically, the survey has a balanced representation, with 58% of respondents hailing from Tier 1 cities and Metros and the remaining 42% from Tier 2 cities, reflecting an overview of digital entertainment preferences across diverse urban-rural landscapes in India.

Source: Press Release

Read More